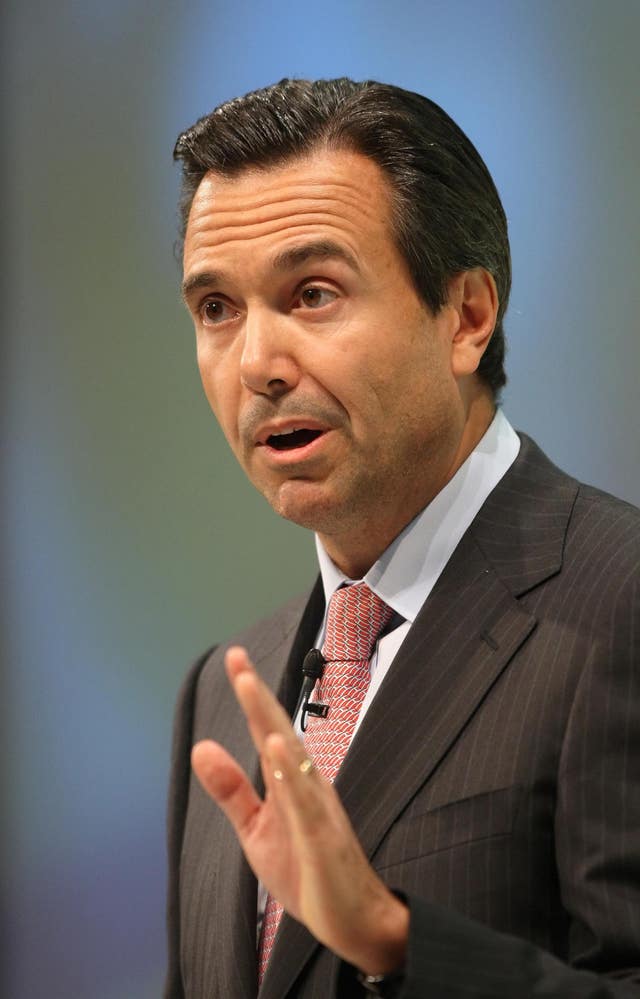

Lloyds is facing the prospect of a shareholder rebellion after giving boss Antonio Horta-Osorio a bumper pay packet that is nearly 100 times the average worker.

Advisory group Institutional Shareholders Services (ISS) has recommended a vote against the banking group’s remuneration report, highlighting discrepancies between “pay and relative performance”.

It turned attention to an “unduly complex” bonus structure and said there is a “lack of clarity in the company’s public disclosures on how bonus outcomes are actually determined”.

“Although pay ratios have not been disclosed, ISS has calculated that the CEO’s pay is 95.0 times that of the average employee in the organisation”, ISS said.

Mr Horta-Osorio took home a total pay package of £6.42 million in 2017, up 10.9% from £5.79 million in 2016.

It came during what Lloyds called a “landmark year” for the bank, having seen bottom line profits surge 24% to £5.3 billion.

Lloyds said in a statement that it was “surprised” with ISS’ recommendation, given that the advisory group backed the new remuneration policy at last year’s annual general meeting, which implemented the pay framework.

“ISS does not challenge the quantum of the awards, which it states are aligned with the Group’s strong performance, but raises concerns about the complexity of the framework,” Lloyds said.

“We do not agree with the assertions made within the ISS report as the group makes a high level of disclosure on the framework it operates.”

While ISS backed the policy, it did note some concerns around changes to deferred pay arrangements which it said resulted in a “higher proportion of the total remuneration package delivered in cash as compared to the previous policy”.

Around 98% of votes cast at at the 2017 meeting were in favour of the policy.

Glass Lewis, another shareholder advisory firm, has recommended a vote in favour of the remuneration report.

If shareholders follow ISS’ recommendations, Lloyds could be next in line following a string of shareholder rebellions over pay.

Bookmaker William saw over 30% of voting investors cast ballots against the firm’s remuneration report at last week’s AGM.

Consternation centred on a 9.1% increase in base salary for boss Philip Bowcock, which will see him take home a total of £1.3 million.

Gambling tech firm Playtech also suffered a bloody nose after 59% of shareholder votes were cast against its own remuneration report following plans to raise the pay of its chief executive Mor Weizer by 78%.

Meanwhile, Melrose – which sealed a controversial £8 billion hostile takeover of engineering giant GKN – saw a total of 22.87% of shareholders reject its remuneration report following a decision to award four bosses at least £42 million each in 2017.

AstraZeneca is also facing the prospect of second straight revolt, with ISS having advised against backing remuneration plans which include paying chief executive Pascal Soriot £9.4 million.

The news comes as Lloyds Banking Group cuts its exposure to the Irish market after selling its local residential mortgage book to rival Barclays in a £4 billion deal.

Lloyds said the sale was in line with its strategy to become a “low-risk, UK-focused bank”, while the proceeds of the sale will be put towards “general corporate purposes”.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here